Lending

The DC Solidarity Economy Loan Fund

BCI manages and distributes funds through the DC Solidarity Economy Loan Fund (DC SELF). Our non-extractive terms ensure that cooperatives who borrow are always made better off financially than before they receive their loan.

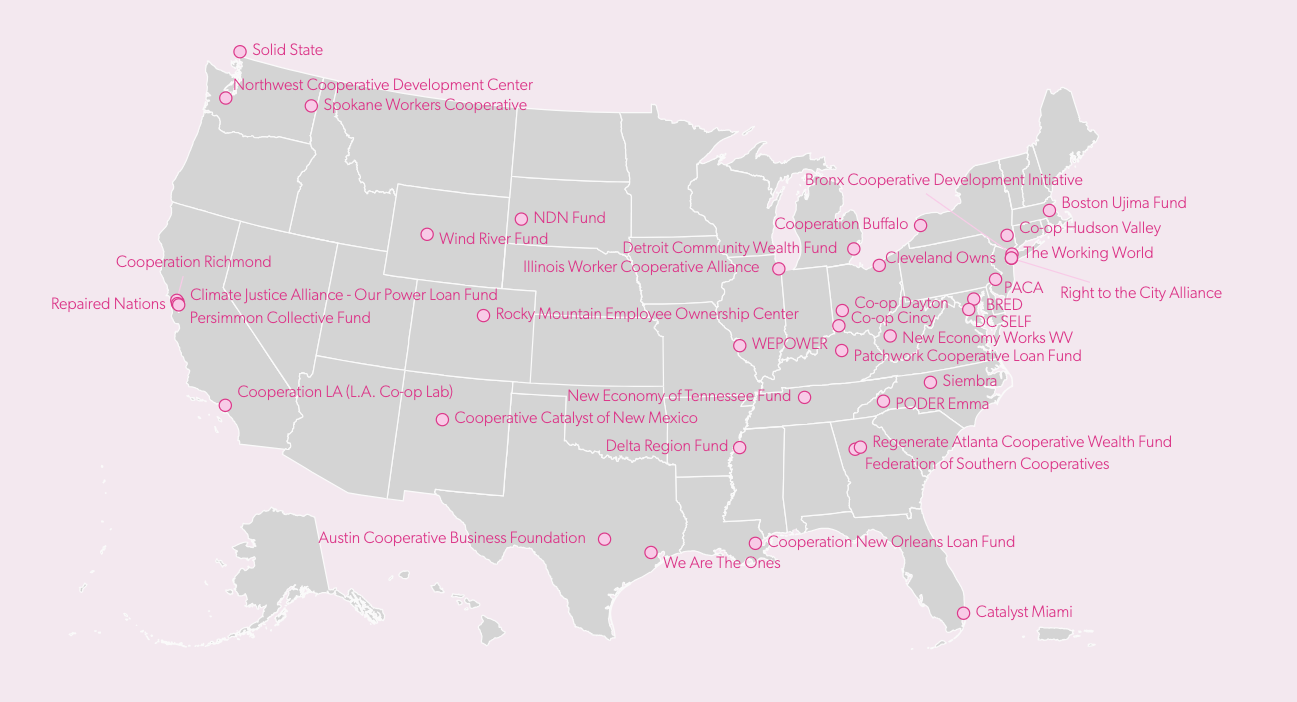

A National Network, Local Connections

DC SELF is a local chapter of Seed Commons’ national loan network — which means we bring the power of big finance to strengthen local projects and cooperatives. Since 2012, Seed Commons has loaned out $100M to local solidarity economy projects across the country.

Economic and Democratic Power

Most loans comes at a cost — if a business fails, the lender walks away with their money, but the impacts on workers, owners and the local community can be devastating. At DC SELF, we believe that risk should remain with the lender, rather than be held by the business.

Non-extractive practices

Our terms are designed to ensure that cooperatives who borrow from us are never made worse off financially than before they receive their loan. Loans are not repaid until businesses have enough revenue to do so, which means co-ops can prioritize living wages and financial stability over loan payments.

No personal guarantees or assets required

Unlike typical lending practices, our loans do not require worker-owners to provide personal guarantees or sign over their assets. This means no matter what happens with your business, you will not lose your personal property to pay a loan back.

Ongoing support

We use a relational model to mitigate risk, and support co-ops throughout the entire process of a loan. You'll have regular meetings with a loan officer during the loan application process and throughout repayment, where you can ask questions, and get support when you need it.

$

M

Given in loans

+

Loans distributed

+

Industries funded

+

Projects funded

CASE STUDY: SWAMP ROSE

Growing a Cooperative Landscaping Business Rooted in Justice and Ecology

Swamp Rose is a worker-owned landscaping cooperative based in the Washington, DC area, founded in 2021 by four friends connected through community organizing.

Interested in Applying for a Loan?

Our Other Sevices

Coop Incubation

We provide incubation from idea to launch for worker-owned cooperatives, collectives, and solidarity economy projects, including technical, administrative, and legal support.

.png)

Network Membership

We support cooperatives and solidarity economy organizations in DC, Maryland, and Virginia with business development, administrative, and legal assistance through the BCI Network.